PHM Pharmamar S.A.

Strong Newsflow Expected in 2017 .

PharmaMar is approaching two key.

Milestones in H217:

* An Approval Decision for Aplidin for Multiple Myeloma in Europe .

* Phase III Results for Lurbinectedin in Ovarian Cancer.

The Chugai licence deal for lurbinectedin in Japan has strengthened the company’s financial position (pro forma net debt €32m) and seen it put increased emphasis on its preferred strategy to either self-commercialise or co-promote lurbinectedin in the US.

Separately, a US manufacturing patent granted last year has extended IP protection for lurbinectedin until at least December 2032.

These developments have prompted us to adopt co-promotion in the US in our base case valuation scenario and to extend our rNPV model to 2035 vs 2030 previously.

Our base case valuation has increased by 29% to €1.29bn (vs €1.01bn), or €5.79/share (vs €4.55/share).

...

LURBINECTEDIN SE APROBÓ EN ESTADOS UNIDOS ... Y PHARMAMAR BAJÓ EL MISMO DÍA /// SE APROBÓ EN SUIZA ... Y PHARMAMAR BAJO EL MISMO DÍA /// SE APROBÓ EN CHINA ... Y PHARMAMAR BAJÓ EL MISMO DÍA ...

16 marzo 2017

PharmaMar . Según el Consenso de Analistas del Mercado ( FactSet ) le dan un Potencial de Subida del 82 % y un Precio Objetivo " Medio " de 4,95 euros . Bloomberg Aconseja " Comprar " .

ISABEL M. GASPAR - 16/03/2017 .

*.- Se espera que este año vuelva al Beneficio con 7 Millones de euros .

*.- La Compañía Prevé que en 2020 habrá otros Tres Nuevos Medicamentos .

Más de un 70% de las compañías cotizadas españolas tiene potencial de subida, según los expertos. Eso sí, entre todas ellas la que destaca, y por mucho, es PharmaMar. Y es que para los analistas sus títulos pueden subir más de un 80%.

Con poco más de 600 millones de capitalización, la antigua Zeltia, se ha convertido en la firma del mercado español que más puede subir en los próximos doce meses, ya que el consenso de mercado que recoge FactSet ubica su precio objetivo en los 4,952 euros por título, es decir, un 82% más que su cotización actual. Además, el 75% de las firmas de inversión que recoge Bloomberg aconseja comprar sus títulos.

La más optimista es Stifel, cuya valoración, en los 6,45 euros, implica más que duplicar su precio. Otras como JB Capital Markets o CaixaBank creen que su precio justo son los 5,3 y 5,5 euros, lo que se traduce en un repunte de entre el 94% y el 102%.

Desde el punto de vista técnico, Carlos Almarza, analista de Ecotrader, "mantiene sus opciones de volver a presionar la importante zona de resistencia que aparece en los 3,15/3,20 euros mientras no pierda los 2,60 euros. Superar los 3,20 euros ya despejaría el camino para mayores ascensos. Perder los 2,60 euros abriría las puertas a ver una mayor corrección hacia los 2,35 euros antes de que las alzas puedan volver a imponerse".

El año pasado el grupo registró 24 millones de pérdidas, principalmente por las mayores inversiones en I+D y la finalización del acuerdo de licencia con la farmacéutica Janssen. No obstante, de cara a este ejercicio los expertos esperan una vuelta al beneficio, hasta los 7,4 millones de euros. Una cantidad que se multiplicaría por 3,2 veces de cara al año posterior.

El producto estrella del grupo es Yondelis, el primer medicamento de origen marino aprobado en Europa que se utiliza para el tratamiento del sarcoma y el cáncer de ovarios. No obstante, el grupo espera que para 2020 ya haya en el mercado tres compuestos para cinco o más indicaciones de diferentes tipos de cáncer. El principal foco de búsqueda de la firma es el Océano Índico y tal y como explican desde la propia compañía, cuentan con más de 200.000 muestras por lo que cuentan con una de las mayores bibliotecas del mundo.

José Luis Moreno, director de Relación con Inversores y Mercado de Capitales de la compañía, explicaba a principios de año en un encuentro con periodistas que uno de los principales atractivos de PharmaMar reside en que tienen "la capacidad de descubrir nuevas moléculas y, además, tenemos nuestra propia red comercial lo que hace que podamos vender directamente nuestros productos".

Kisqali . Will Pfizer's Growth Be Threatened by Novartis' New Cancer Drug? .

Novartis' New Cancer Drug Kisqali stands ready to challenge Pfizer's Ibrance. But how serious is the threat? .

Keith Speights (TMFFishBiz) Mar 15, 2017 ,

Novartis (NYSE:NVS) announced on Monday that the U.S. Food and Drug Administration (FDA) approved Kisqali as a first-line treatment for hormone receptor positive, human epidermal growth factor receptor-2 negative (HR+/HER2-) breast cancer. Soon, stories were running warning about the threat the new drug could pose to Pfizer (NYSE:PFE).

Novartis (NYSE:NVS) announced on Monday that the U.S. Food and Drug Administration (FDA) approved Kisqali as a first-line treatment for hormone receptor positive, human epidermal growth factor receptor-2 negative (HR+/HER2-) breast cancer. Soon, stories were running warning about the threat the new drug could pose to Pfizer (NYSE:PFE).

It's certainly true that Kisqali is going to compete against Pfizer's successful cancer drug Ibrance. But will Novartis actually threaten Pfizer's growth prospects?

Ibrance vs. Kisqali

Late-stage study results appear to indicate similar efficacy for Ibrance and Kisqali, although no direct head-to-head studies have been conducted. Pfizer reported a median progression-free survival (PFS) rate of 24.8 months for women taking Ibrance plus letrozole compared with 14.5 months for patients taking letrozole alone. Novartis reported a median PFS of 25.3 months for Kisqali plus letrozole and 16.0 months for letrozole alone.

Novartis is pricing Kisqali at an 18% to 20% discount below Ibrance's price, however. Could this lower price cut into Pfizer's sales? Maybe, but there's another important consideration.

Kisqali can cause a heart rhythm disorder known as QT prolongation, which can result in fast, chaotic heartbeats and even lead to death. Physicians will have to closely monitor patients taking the drug.

That could be problematic for Novartis. Physicians could prefer to prescribe Ibrance rather than Kisqali, since Ibrance doesn't have the safety warning related to QT prolongation. The primary safety issue that can occur with taking Ibrance (neutropenia) also occurs with Kisqali.

...

Keith Speights (TMFFishBiz) Mar 15, 2017 ,

Novartis (NYSE:NVS) announced on Monday that the U.S. Food and Drug Administration (FDA) approved Kisqali as a first-line treatment for hormone receptor positive, human epidermal growth factor receptor-2 negative (HR+/HER2-) breast cancer. Soon, stories were running warning about the threat the new drug could pose to Pfizer (NYSE:PFE).

Novartis (NYSE:NVS) announced on Monday that the U.S. Food and Drug Administration (FDA) approved Kisqali as a first-line treatment for hormone receptor positive, human epidermal growth factor receptor-2 negative (HR+/HER2-) breast cancer. Soon, stories were running warning about the threat the new drug could pose to Pfizer (NYSE:PFE).It's certainly true that Kisqali is going to compete against Pfizer's successful cancer drug Ibrance. But will Novartis actually threaten Pfizer's growth prospects?

Ibrance vs. Kisqali

Late-stage study results appear to indicate similar efficacy for Ibrance and Kisqali, although no direct head-to-head studies have been conducted. Pfizer reported a median progression-free survival (PFS) rate of 24.8 months for women taking Ibrance plus letrozole compared with 14.5 months for patients taking letrozole alone. Novartis reported a median PFS of 25.3 months for Kisqali plus letrozole and 16.0 months for letrozole alone.

Novartis is pricing Kisqali at an 18% to 20% discount below Ibrance's price, however. Could this lower price cut into Pfizer's sales? Maybe, but there's another important consideration.

Kisqali can cause a heart rhythm disorder known as QT prolongation, which can result in fast, chaotic heartbeats and even lead to death. Physicians will have to closely monitor patients taking the drug.

That could be problematic for Novartis. Physicians could prefer to prescribe Ibrance rather than Kisqali, since Ibrance doesn't have the safety warning related to QT prolongation. The primary safety issue that can occur with taking Ibrance (neutropenia) also occurs with Kisqali.

...

Tasigna . Cancer Drug That Might Slow Parkinson's, Alzheimer's Headed For Bigger Tests .

March 15, 2017 // JON HAMILTON .

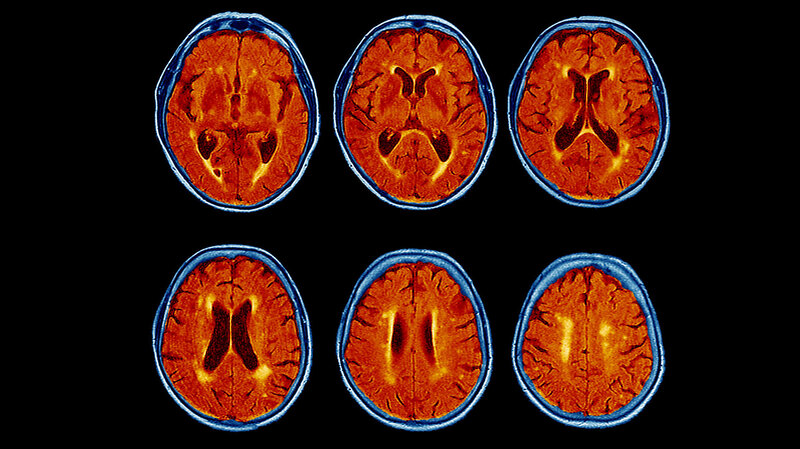

Scientists are hoping that a single drug can treat two devastating brain diseases: Parkinson's and Alzheimer's.

The drug is nilotinib, which is approved to treat a form of leukemia.

The drug is nilotinib, which is approved to treat a form of leukemia.In late 2015, researchers at Georgetown University Medical Center found that small doses of the drug appeared to help a handful of people with Parkinson's disease and a related form of dementia. They'd tried the unlikely treatment because they knew nilotinib triggered cells to get rid of faulty components — including the ones associated with several brain diseases.

Results of that preliminary study generated a lot of excitement because there is currently no treatment that can slow or halt the brain damage caused by either Parkinson's or Alzheimer's.

"Our phones were basically (ringing) off the hook," says Fernando Pagan, medical director of the translational neurotherapeutics program at Georgetown.

Many researchers were cautious, though. "It was such a small trial, there was no placebo control and it really wasn't designed to assess efficacy," says J. Paul Taylor, chair of the cell and molecular biology department at St. Jude Children's Research Hospital in Memphis.

So Georgetown is launching two larger and more rigorous trials of nilotinib, both designed with input from the Food and Drug Administration. One of the trials will enroll 75 patients with Parkinson's disease, the other will enroll 42 patients with Alzheimer's.

...

Suscribirse a:

Comentarios (Atom)